Auto Insurance in and around New Albany

Discover your car insurance options from State Farm

Take this route for your insurance needs

Would you like to create a personalized auto quote?

Insure For Smooth Driving

Driving is likely a common aspect of your daily routine. Whether you drive a mini van or a scooter, you count on that vehicle to take you where you need to go, which is why excellent coverage for when the unanticipated occurs can be so vital.

Discover your car insurance options from State Farm

Take this route for your insurance needs

Coverage From Here To There And Everywhere In Between

That’s why you need State Farm auto insurance. When the unexpected happens, State Farm is there to get you back on track! Agent Bob Bitner can walk you through the whole insurance process, step by step, to review State Farm's options for coverage and savings. You’ll get dependable coverage for all your auto insurance needs.

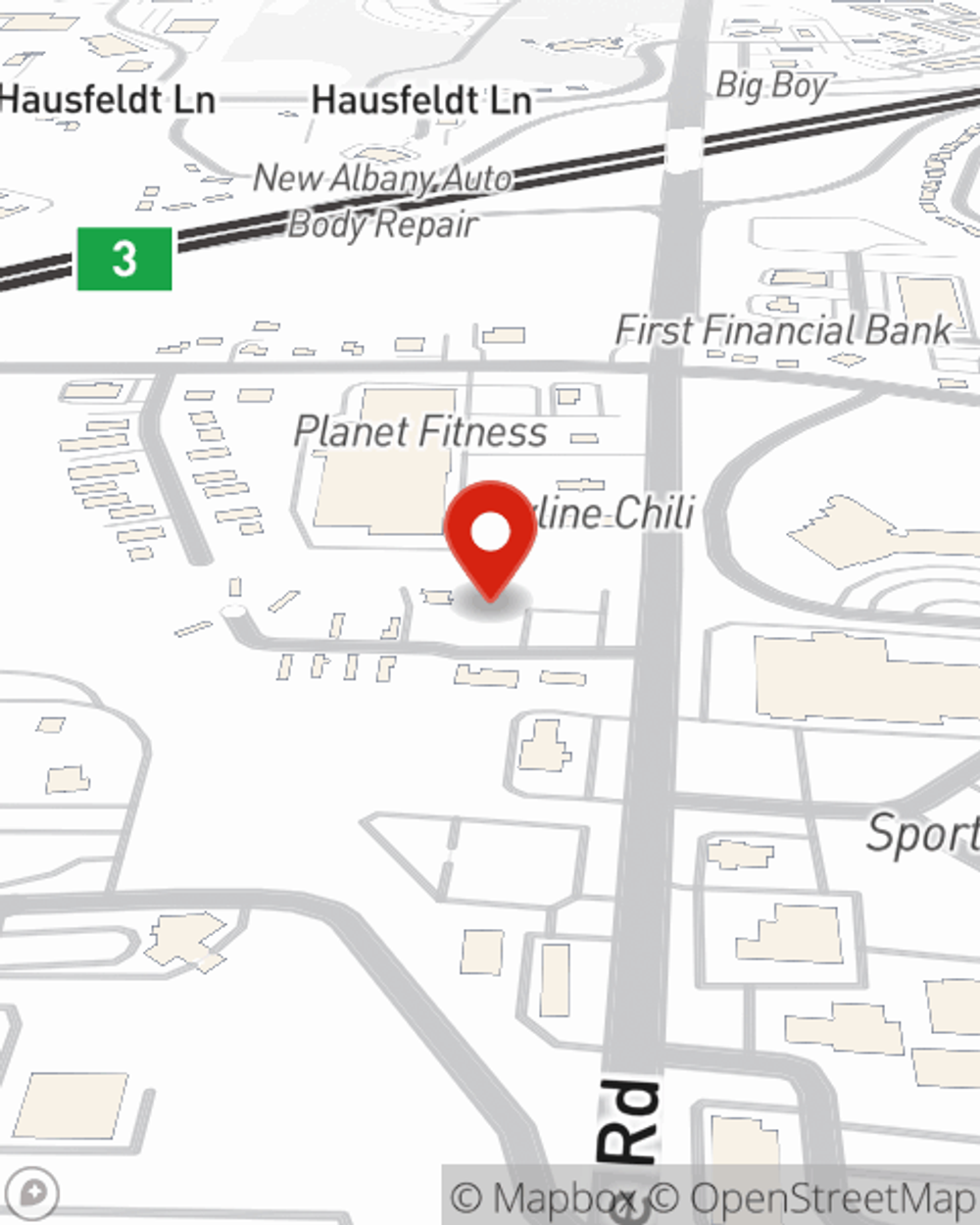

New Albany drivers, are you ready to find out what a State Farm auto policy can do for you? Get in touch with State Farm Agent Bob Bitner today.

Have More Questions About Auto Insurance?

Call Bob at (812) 945-2743 or visit our FAQ page.

Simple Insights®

What riding gear do I need for a motorcycle?

What riding gear do I need for a motorcycle?

Motorcycle riding gear is specifically designed to keep your head and body safer when riding.

Do I need comprehensive car insurance?

Do I need comprehensive car insurance?

Is comprehensive auto insurance right for you? Consider vehicle value, risks, deductibles and your budget to choose the right coverage for you.

Simple Insights®

What riding gear do I need for a motorcycle?

What riding gear do I need for a motorcycle?

Motorcycle riding gear is specifically designed to keep your head and body safer when riding.

Do I need comprehensive car insurance?

Do I need comprehensive car insurance?

Is comprehensive auto insurance right for you? Consider vehicle value, risks, deductibles and your budget to choose the right coverage for you.