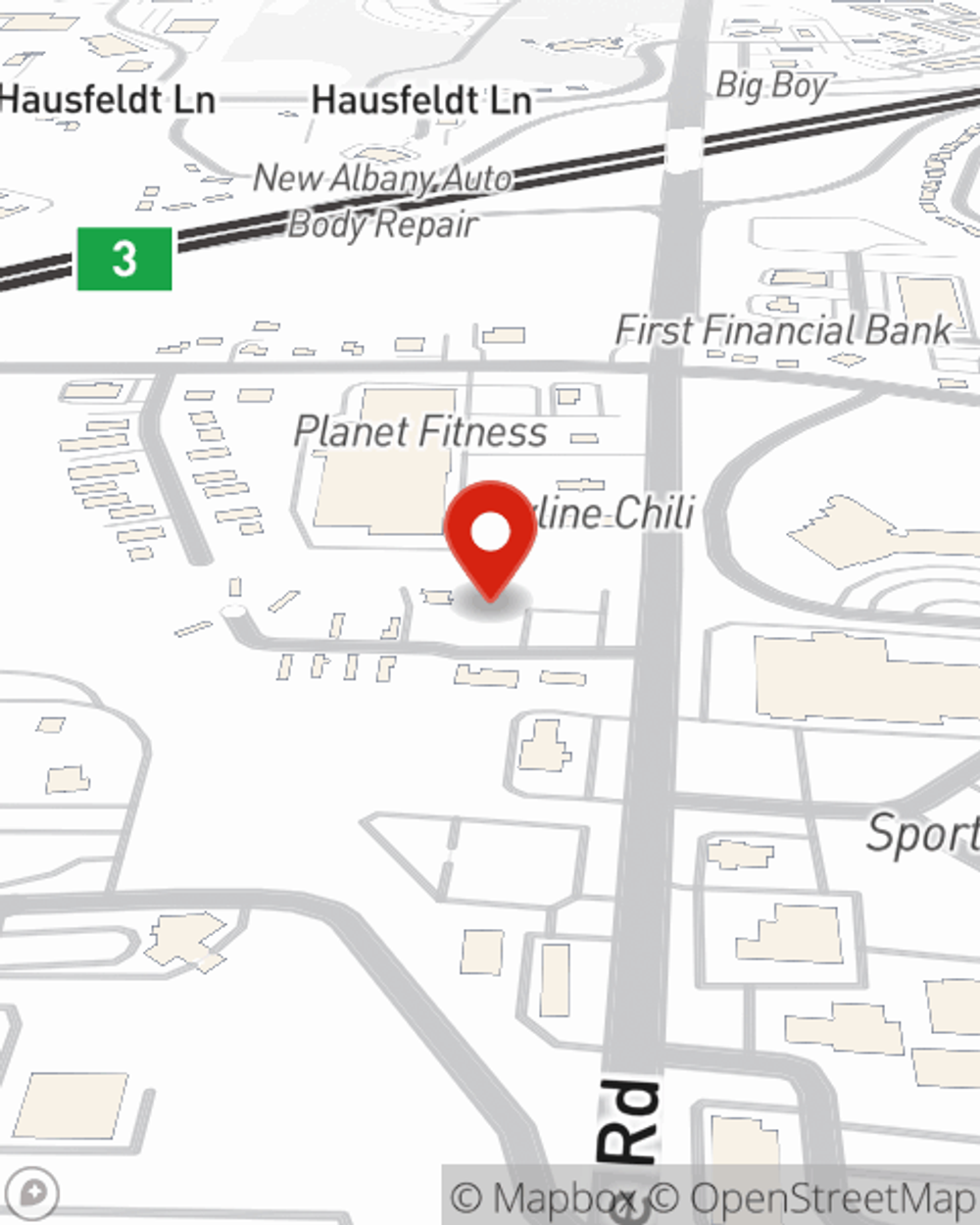

Life Insurance in and around New Albany

State Farm can help insure you and your loved ones

Life happens. Don't wait.

Would you like to create a personalized life quote?

Be There For Your Loved Ones

The typical cost of funerals nowadays is around $8,300, according a recent study by the National Funeral Directors Association. Unfortunately, it may be difficult for the people you love to pay for your burial or cremation as they grieve. That's where Life insurance with State Farm comes in. Having the right coverage can help the ones you leave behind afford funeral arrangements and not fall into debt.

State Farm can help insure you and your loved ones

Life happens. Don't wait.

Agent Bob Bitner, At Your Service

You’ll get that and more with State Farm life insurance. State Farm has fantastic coverage options to keep those you love safe with a policy that’s modified to correspond with your specific needs. Thankfully you won’t have to figure that out on your own. With strong values and fantastic customer service, State Farm Agent Bob Bitner walks you through every step to build a policy that secures your loved ones and everything you’ve planned for them.

More people choose State Farm® as their life insurance company over any other insurer. Are you ready to see what a company that processes nearly forty thousand claims each day can do for you? Reach out to State Farm Agent Bob Bitner today.

Have More Questions About Life Insurance?

Call Bob at (812) 945-2743 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

Whole Life insurance

Whole Life insurance

What is the difference between Ordinary life and Limited-payment life? Read about some common uses for Whole Life Insurance.

Simple Insights®

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

Whole Life insurance

Whole Life insurance

What is the difference between Ordinary life and Limited-payment life? Read about some common uses for Whole Life Insurance.